- Batteries and alternative drives also change spare parts logistics

- Experts recommend to adapt to the parallel parts world for combustion engines, hybrid drives and electric vehicles in due time

- Automation as a prerequisite for new business models and services

(Marchtrenk, 4 May 2022) Climate change drives the market for vehicles with alternative drives. With a delay, this will also have consequences for the spare parts market and its logistics. TGW Logistics Group recommends companies to create the conditions for the new era in due time with automation and digitalisation. Powerful technologies for a future that is increasingly hard to predict are available.

Author: Erich Schlenkrich, Industry Manager Industrial & Consumer Goods

At the moment, most cars in Germany have a combustion engine, but about 14 percent of the vehicles newly registered in 2021 have an all-electric drive. The share of electric vehicles almost doubled compared to the previous year. Electric, hybrid and hydrogen vehicles present car manufacturers and suppliers with enormous challenges: from program planning and the scheduling of production orders to an impending decrease in spare parts orders. Some manufacturers and dealers have been making up to 70 percent of their profits this way.

Fewer parts, less logistics?

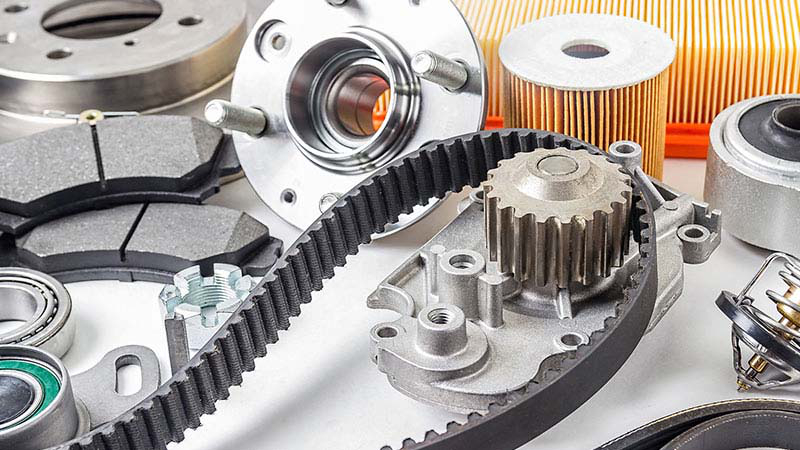

The triumph of e-mobility leads to a reduction in spare parts, because a combustion engine consists of more than 1,400 components, while an electric motor has only about 200. Furthermore, electric cars require fewer repairs on average, because they are constructed differently. However, fewer motor parts does not equal fewer logistics activities, at least not in the medium term.

One reason is that cars in Europe are on average nine years old, which means that spare parts for electric cars sold today will only be needed in several years and until then, spare parts for combustion engines will dominate the market. Another reason is that current after sales logistics are way more complex than even one decade ago, because a parallel world of combustion engines, hybrid drives and electric models has been created. And parts for diesel- and gasoline-powered vehicles will be stocked for a long time: Many original equipment manufacturers (OEM) will keep them on stock for ten to 15 years after the end of production.

A high degree of unpredictability is another aspect that makes this topic so complex. Zero emissions does not mean zero problems. Many unanswered questions unsettle manufacturers and customers alike: Where will problems for the procurement of raw materials for battery production arise? How is recycling going to be regulated? These are only two of many questions.

Digitalisation and automation as key factors

Developments that are difficult to predict, more complex business deals, new services: Experts agree that this situation can only be resolved with automation and digitalisation. Admittedly, the situation will not change overnight, but sitting back and waiting is the wrong strategy. This is because spare parts for hybrid models will already be needed in three to four years. Given the realisation time of large automation projects, companies should lose no time. What is more: Digitalisation also allows competitors to launch retail platforms in the blink of an eye. If you cannot maintain your service level, you will lose customers, and winning them back is hard. High quality and fast delivery are still the be-all and end-all in this business. This is why high availability and agile logistics are more important than ever for manufacturers and dealers.

Skills shortage drives development

Another argument for automation is the increasing skills shortage. The situation will definitely become even more difficult, because demographic change cannot be stopped. A high degree of automation helps companies to prepare for uncertain times. It is currently unclear which share fossil fuels, e-fuels, LPG, hydrogen and electricity will have in ten or 15 years' time.

3D printed spare parts are not a panacea either. One reason is that many spare parts have high quality requirements that 3D printed parts cannot fulfil (yet). Furthermore, the new production method has only paid off for small quantities so far.

New services, changed customer behaviour

Whether you are a manufacturer or a supplier, you should keep an eye on new services. In Europe, for example, more and more spare parts specialists are also offering equipment and material for repair shops. In the USA, where money is usually made with large volumes, paid trainings and consultations for customers have become an extra source of income. Battery replacement, storage and repair will play a major role in the future. Even more training might be needed when not only lithium-ion batteries are used, but also other technologies for energy storage.

Another driver for the service business is the changed consumer behaviour. Back in the day, car enthusiasts could repair their own vehicles; some even had fun doing it. Today, the products on four wheels are so complex that customers are hardly able or willing to repair them themselves. They expect their car to run more reliably than before thanks to preventive maintenance – and that help will arrive quickly at the click of a button on their smartphone if it comes down to it. Therefore, more and more manufacturers rely on self-diagnostic systems and preventive maintenance.

High service level, fast delivery

TGW observes these developments closely and permanently incorporates findings into its solutions. The best of the best on the market have already established a global logistics network, digital processes and a structured inventory management. They score with a high service level and fast delivery.

With FlashPick®, TGW has a system in its portfolio that allows customers to adapt flexibly to different scenarios – and provides answers for the most important questions about efficiency and profitability. It is all about reacting to fluctuations in demand, a high service level and skills shortages. In practice, this means: Compared to other systems, express orders can be integrated into the daily business without problem. Only a few minutes pass from electronic order intake to the package being ready to ship.

Digital maintenance of intralogistics systems

For maintenance and support, TGW uses modern tools such as data glasses that provide employees in the installation with information via a live stream. The digital maintenance management CMMS is state-of-the-art. Condition-based monitoring is also used. This means that sensors are used to acquire status data for important components and compare it to the empirical values in the centralised database. Maintenance models are then developed on the basis of this data.

Furthermore, TGW is working on making the handling of slow-moving items more efficient by means of the latest technology. These solutions are also very important for value added services, to offer users the highest degree of flexibility. The same applies to the customers and TGW: If you are prepared, you have an advantage in business.